Yes. It is possible to transfer money from Venmo to PayPal. However, despite the fact that these two apps have much in common, there is no direct way yet to achieve this. Being among the top popular e-wallets, the inter accounts funds transfer isn’t just a necessity but a need. As of now, there is only one way to achieve this objective.

Transfer Via a Mutual Bank Account

To transfer your money from the Venmo account to a PayPal account, you need a mutual bank account. That means a bank account connected to both Venmo and PayPal accounts. It acts as a bridge because the two platforms aren’t directly connected.

After setting up your joint account, make sure you have the PayPal cash or PayPal cash plus account. You shouldn’t fret over this, though. You can do it as long as you have a verified PayPal account.

To initiate the transfer process, move the amount you want to transfer from the Venmo account to the bank account. To do this, follow the steps below;

- Log in to your Venmo account and navigate to the menu button.

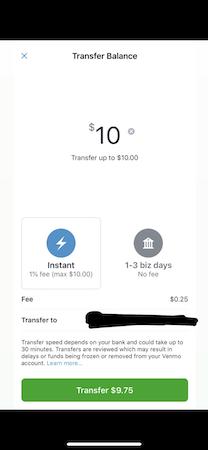

- Click on the Transfer Money option to open the transfer menu.

- Choose and tap the transfer to the Bank option. Here you can change the amount you want to send.

- Chose the mode of transfer. Whether instant or the normal. For instant transfer, you’ll pay a 1% fee, whereas the free transfer is free but can take up to three business days.

- Select your bank and confirm the transfer by pressing the green button. Depending on your mode of transfer, the money can reflect within seconds or days.

Once the funds are in the common bank account, it’s time to move them to your pay pal account. Below are the steps to do that;

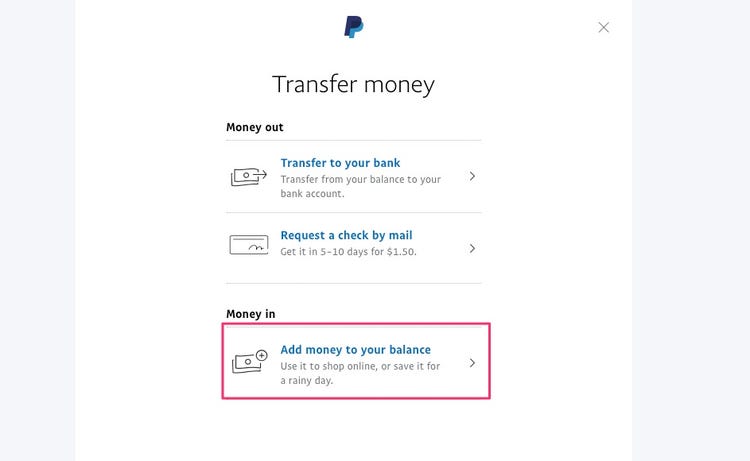

- Log in to your PayPal account and navigate to balance.

- Click Add Money then Add from Your bank tab. If you selected instant money transfer, you’d see the funds already in the bank. Otherwise, you may have to wait up to three days before you can move the funds.

- Fill in the amount you want to transfer and press continue.

- Confirm the process and click Add Money. The process takes between three to five business days until the money can reflect in your account.

Venmo and PayPal apps are available for both android and iOS users. It’s what makes them so popular besides being user friendly. Even if you don’t have mobile apps, you can still rely on the browsers to accomplish this. The steps are similar.

Comparisons Between Venmo and PayPal

PayPal owns Venmo. So, we can vaguely say they are independent platforms running on a similar infrastructure. This makes them have as many differences as similarities. Some of them include;

- International payments – Venmo is currently only limited to United States users. Therefore, you cannot rely on it to make international payments. In contrast, PayPal supports over 25 different currencies in more than 200 countries.

- Target audience – While PayPal targets individuals and businesses, Venmo aims more at tapping social pool. Venmo is more reliable for money transfer between social circles and trusted individuals. PayPal users don’t have to know or trust each other as consumer protection measures are already in place.

- Fraud protection – since Venmo is meant for use between trusted contacts, it lacks comprehensive protection features. PayPal being a global entity where strangers transact has extensive buyer and seller protection policies and fraud detection tools.

- Unique features – PayPal is a more feature-rich app compared to Venmo. Actually, currently, it’s almost becoming a fully-fledged bank. PayPal has unique business features making it easier for sellers and buyers to transact business successfully. It has also introduced a debit MasterCard that can be used at POS, business loans for small businesses, etc.

FAQ – Frequently Asked Questions

Is Venmo balance able to be transferred to PayPal balance?

Yes. However, this is not a direct endeavor. You have to send your money via a mutual bank then withdraw to a PayPal account.

Are there any costs to accept Venmo payments?

No. There are no extra charges involved to accept payments via Venmo. The Venmo fee is the same as that charged for PayPal payments.

Are Venmo payments available for desktop transactions?

No. Venmo payments are only possible for instant mobile transactions, not desktop.

What is the meaning of payment sent to “New User” mean?

It simply means that your Venmo payment was deposited to an email or phone number that doesn’t have an active Venmo account.

Can I cancel my Venmo payment?

No. It is not possible to cancel a Venmo payment after processing. It is a very swift process and, once completed, cannot be reversed—there are two available options for sorting a wrongful payment.

Contacting the recipient to refund you, or you can cancel the payment if it is made to a non-existing account. To cancel the payment, follow these steps;

- Log in your Venmo account and Tap on the menu tab.

- Click incomplete.

- Tap the payment tab.

- Click the cancel option below the payment option. The transaction will be reversed and the amount deposited back in your account.

Can I pay someone on PayPal with Venmo?

No. It is not possible to make cross-platform payments as of now.

Which is better between the Venmo and PayPal?

While the two apps have almost similar functionalities, they both have their strengths and weaknesses. Depending on the features that you want, and can stand out. For example, people who receive or send small amounts of cash daily, Venmo is their best fit. PayPal, on the other hand, is the go-to app for people making constant online purchases.

Does PayPal’s Seller Protection Policy cover Venmo transactions?

Yes. If you receive Venmo payments via your PayPal account, PayPal’s Seller Protection Policy covers you.

Recap

Money transfer from Venmo account to PayPal isn’t among the quickest method. But yes, it is doable. With a bank account linked to both accounts, you can do this comfortably. The two major drawbacks of this method are the time factor and geographical limitations. If you are in a hurry to get your cash, it may not be very convenient for you. The wait time of up to five working days isn’t palatable. The geographical limitation is that Venmo is only applicable to users within the United States.

As of now, there is no alternative. All we can do is hope for a more convenient method in the future. With PayPal acquiring Venmo, much is ongoing, and hopefully, there could be other options in the offing.