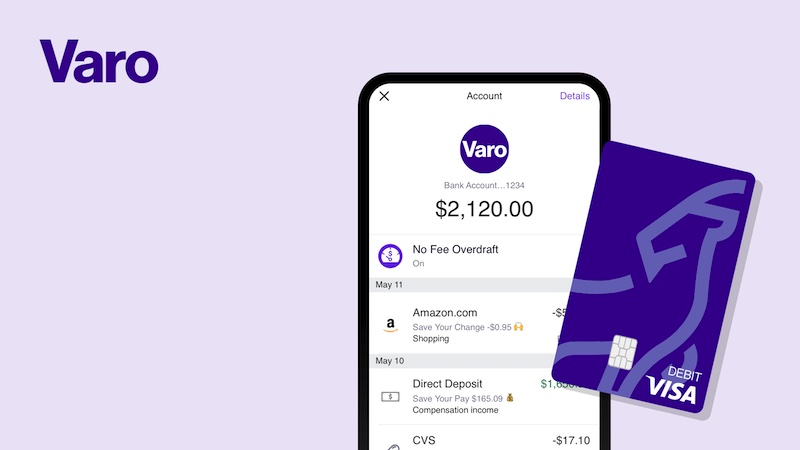

Varo is an American, digital, and mission-driven online bank that provides financial services to its clients through mobile apps. The bank was founded with millennials and the young in mind, who naturally get disillusioned with queues and lagging services from traditional banks. Therefore, Colin Walsh and Kolya Klymenko created this bank to eliminate the need to visit physical banks to access your money.

The bank helps you control your money from the comfort of your home with no credit check, no monthly fees, no overdraft fee, and no minimum balance. There are several ways to withdraw money from Varo. Many ask, is it possible to withdraw money from Varo without a card? To find more answers to this question, read our guide to the end.

What Is Varo Card?

Before expounding ways on how to withdraw money from Varo without a card, we have explained in detail what this Varo card is for better understanding.

Therefore, Varo card is a card provided after opening an online account with Varo bank. This card is majorly used to withdraw money from Allpoint ATMs, paying bills, and conduct other relevant online/offline transactions. What happens to your Varo account after misplacing this card?

How Can You Withdraw Money From Varo Without A Card?

Accidentally, you might misplace your Varo card, get stolen, and leave you wondering how to access your money from Vero without a card. Unfortunately, there is no direct method of withdrawing money directly from Vero bank account without a card. However, all is not lost. This is because there are other workarounds that will help you access your Varo money without a card. These alternatives are:

1. Use of card-less ATMS

Varo allows Allpoint ATM withdrawal with a card that helps to make banking experience better for their clients. However, without a card, you can opt for the card-less ATM instead of a card-enabled ATM. This machine allows you to withdraw money from your account in absence of a physical card. How?

To withdraw money from a card-less ATM

- Install Varo mobile app in your mobile device.

- On the app, select the ‘’move money’’ section.

- Next, select ‘’find ATM’’ option. This brings to you Allpoint ATMS that are around.

- In the locator, identify any card-less ATM around Sand visit it.

- In the ATM, swipe to find out whether it has ‘’mobile cash access’’ option. If yes, select it.

- Launch Varo on your phone, allow it to load banking services, look for ‘’card-less ATM withdrawal and tap to ‘’select’’.

- From your mobile app, enter the desired withdraw amount \and give the app time to generate a pin.

- On the ATM’s screen, enter your mobile app generated pin and wait for the machine to withdraw the money.

| Pros of this process | Cons |

|---|---|

| You can conveniently withdraw money from Varo without a card | Card-less ATMs are not everywhere hence might be hectic to find one |

| It eliminates the risk of scammers stealing your bank card |

2. Withdraw through a friend

Do you wish to withdraw money from Varo but you misplaced your card? You can talk to a friend to withdraw money for you through their cards. This is by transferring money from your Varo account to your friend’s account. Varo has made this process absolutely easy and fast. To transfer:

- Log in to your installed Varo App.

- At the bottom of the page on the screen, tap ‘’move money’’

- Next, select ‘’Varo to Varo transfer.

- Next, you are required to dial an email of the account holder that you are sending the money. In this case, your friend.

- Feed the amount that you wish to transfer

- Go through the transfer thoroughly to ensure you filled correct details.

- Finalize the process by tapping ‘’send money.

After sending money to your friend’s account, he/she can now go ahead and withdraw it for you.

| Pros of this process | Cons |

|---|---|

| The transfer is instant | You might lose your money if the friend is not unfeigned |

| No fees charged |

3. Transfer money to an external bank account

Although Varo doesn’t allow direct money withdrawal from the account without card, there are a number of banks that allow it. Therefore, you can send money to one of those banks from Varo. This process has two steps: in the first step, you are required to link the external bank with Varo app and the final step is transferring money from Varo to your external bank. Below, we have explained the two steps in detail.

Link Varo bank account with an external bank.

- Open Varo bank app.

- Tap ‘’link an account’’ at the bottom page of your app.

- Select the name of the external bank that you wish to transfer the money.

- You will be required to login by entering your username and password.

- Tap ‘’submit’’, and respond to any prompt from Varo bank until you link to your external account.

- You will see your external account’s details like account number and bank balance. This shows that you have successfully linked it with Varo.

Transfer money from Varo to the external bank.

- Refresh your Varo bank app.

- Select ‘’transfer money’’

- Select ‘’ move money from Varo bank account to your external account’’

- Enter the amount you wish to transfer and tap ‘’transfer’’

| Pros of this process | Cons |

|---|---|

| Safety guaranteed as you are transferring money to your second bank | Transfer from Varo to external account takes time |

| It will be instant to withdraw money from your external bank | There is transfer limit from Vero external account |

Is Varo Card-less Withdrawal Safe And Legit?

Yes. Whether you have a card or not, Varo money withdrawal is safe and legit. With a card, Varo bank allows withdrawal of money from Allpoint ATMs or from credit union branches through a safe and legit process. You can also withdraw money from Varo without a card through alternative methods mentioned above. All these methods are safe and legit.

Also, Varo bank is among the best online bank accounts and also included as one of the Forbes Advisors’ best online banks. This makes all their financial transactions safe, legit and straightforward.

Varo Customer Care Services

When withdrawing money from Varo account without a card, you might experience one or two problems. For instance, delay while transferring money from Varo to an external account. You might also need to seek guidance on how to withdraw money using a card-less ATM.

You can therefore reach out to Varo customer services by calling them through 1-800-827-6526 every Monday to Friday, 8AM TO 9 PM EST, Saturdays and Sundays 11 AM TO 7 PM EST. You can also email them: [email protected]

FAQs – Frequently Ask Questions

How many accounts do Varo bank offers?

Varo offers two major accounts; Checking and saving account. Varo checking account is the primary bank account that does not charge any maintenance or registration fee. Also, it doesn’t require any minimum balance. To sign up for this account, you need your legit ID, social security number and prove that you are above 18 years old.

Varo saving accounts is opened on condition that you have a checking account. The account encourages saving of money by offering a 0.20% annual yield of your saved amount. However, it doesn’t have any minimum deposit requirement.

Do Varo charge any withdrawal fee?

No. withdrawing money from Varo is priceless. The company has more than 55000 Allpoint ATM network all over the US that allow you to withdraw money from Varo with zero charges. However, note that you will be charged to withdraw money from external ATM networks. Therefore, to avoid withdrawal charges, avoids Varo withdraws from third-party ATMs.

How do you locate Varo bank withdrawal ATMs?

As mentioned above, Varo has 55000+ ATM machines to withdraw money across the country. To locate these machines near you, use the Varo ATM locator in your Varo app. To access this locator, open Varo app, tap ‘’move money’’, and then ‘’find ATM’’.

Do Varo have withdrawal limit?

Yes. Varo bank has a withdrawal limit of $500 daily from the Allpoint ATMs. Hover, when it comes to withdrawing over the counter from credit union, this limit increases to $1000 per day. Therefore, we conclude that Varo withdrawal limit is $1000 per day.

Can you withdraw money from Varo account through Google Pay?

You can link your Varo account to Google Pay and opt for it as a funding alternative. The process of linking these two accounts is absolutely simple. All you need to do is; open your Google pay wallet, tap your wallet’s profile picture, select ‘’bank account’’ then’’ add card’’. Here, you should enter your Varo bank card details the ‘’save’’. Accept terms and conditions and activate the card. This allows you to use your Varo card to through Google pay.

Which other digital wallets can you use with Varo account?

Besides Google pay, you can also withdraw money from Vero account without a card from digital wallets like PayPal, Apple Pay, and Cash App.

Final Take

Technology is gradually taking over the world. As far as banking is concerned, Varo online banking has made financial transactions easier, faster, and less hectic. There are also methods to withdraw money from your account without a card as seen above. This has eliminated the need to carry cards around reducing fraud and theft. They have also expedited and simplified purchases and paying off bills. Connect with Varo banking today and enjoy their services. We hope this guide has been of help to you.

Thanks for your blog, nice to read. Do not stop.