Trading is a daily activity that began centuries ago and every person engaged in it. It involved the exchange of goods and services until the introduction of currencies. The introduction of money as a medium of trade affected the market in a great way. It is what led to the emergence of the need for money management channels. Banks became the central operation and control currency points. They saved, loaned, and transferred cash on behalf of their customers.

Over the years, banks have seen momentous evolution and technological advancement. Over the years, checks have remained very instrumental in bank transactions. These are documents used to make payments from one person’s account to another. One major strength of checks is that there are no specific checks for certain banks. That means you can receive a check from any bank and credit it to your account.

For smooth banking, the American Bankers Association (ABA) introduced routing numbers. This was to eliminate confusion in check processing. They act as unique identifiers of the banks’ location. So, even if several banks have similar names, but routing numbers will identify them. Mobile money apps and eCommerce are among the greatest beneficiaries. Here, they help in processing checks both in direct deposits and electronic payments.

The number identifies which bank holds the account where the check originates. Despite the banking evolution, the function of the routing number has not changed. The number works for both banks and the credit unions as their address.

What Does ABA Routing Mean?

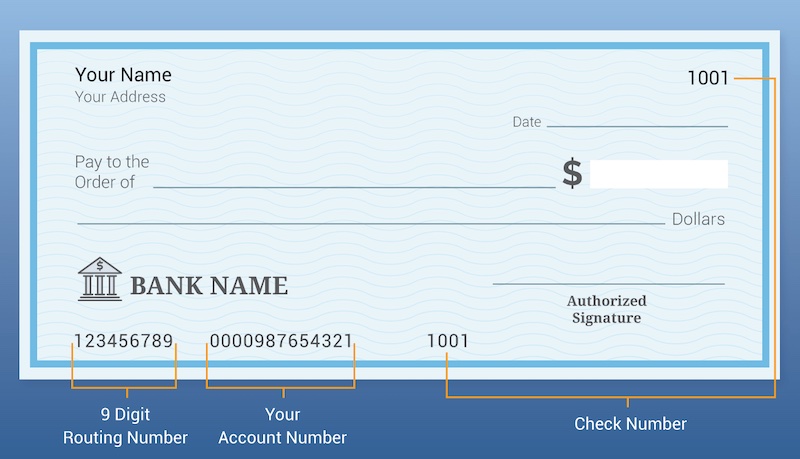

A routing number is a nine-digit number printed on the bottom left of every bank check. Developed by the ABA in 1910, it identifies the bank or financial institution. Magnetic Ink Character Recognition used for the printing gives them special features. These make the checks easy to sort and read. Also, the routing number is the same as the ABA routing transit number (ABA RTN).

Routing Number Vs Account Number

Routing and account numbers are on the same line at the bottom of a check. You can also find them in your online banking account profile. They are in three groups at the bottom of the check. Despite the striking resemblance, they also have major differences. Below is a summarized comparison between the two;

Similarities

- They both help in identifying the bank account and give a directive on how to process the check.

- The routing number identifies the Federal Reserve District.

- The routing number identifies the bank or financial institution with the identified district.

- The account number gives the address of the account identified by the routing number.

Differences

- The routing number has nine digits while the account number digits may vary between 5 to 10 digits.

- 2. Each bank can choose its format of the account number. But, the routing number format is in the Routing Number policy.

Process To Find Your Routing Number

1. Find Your Routing Number on a Check

The routing number is a 9-digit code found at the bottom of the check. It is a unique code based on the location of the bank where the account was opened.

2. Find Routing Number On Bank Paper Statement

There is no provision of routing numbers on the bank statements by most banks. So, you can only find it on checks and mobile apps. Alternatively, you can contact customer care. You can also visit the ABA website for a list of routing numbers.

3. Find Routing Number Without a Check

The routing numbers can either be on your check or online profile. In cases where you do not have the check, you can log into your online account. You will find it listed together with other account details like name and account number. You can as well call customer care to inquire about it.

4. Find Your Routing Number Through Online Banking

You can find the routing number online. You need to login into your online banking platform. Select your account. The routing number is a nine-digit code listed together with your account details. Some platforms will state it as a routing number or ABA RTN.

5. Find Your Routing Number Through Apps

Different banking apps have different ways of checking the routing numbers. Moreover, apps have different designs and features. This means that you can get the RTN but it is not uniform in all apps. Thus, you have to navigate the app to get the routing number.

6. Bank Customer Service

If you are unable to get your routing number online or on checks, you can call the bank customer care. You can also visit your local bank customer desk to get the routing number.

Do Routing Numbers Change? What To Do?

Yes. Routing numbers do change when the ownership changes or merges with another bank. Before the bank merges, you may be having a lot of services tied to your account. You may also receive direct deposits when the merging or acquisition is happening. When this happens, it is important to update everything with the new routing number. However, there is a process that you should follow when updating it.

Follow the bank instructions when routing and account number change

At times, the administration or management of financial institutions can transfer bank ownership. When such happens, the bank or the credit union will inform you of the change in your routing number. The bank will tell you also about the need to update your credentials. In most cases, banks give notices before the routing number change. Fortunately, the old routing number will continue working despite for some time. But, the banks and credit unions prefer an immediate switch to the new routing number.

You should update the routing number for automatic deposits and withdrawals

Most automatic transactions use the routing number. If you have automated monthly transactions, you should update the parties on time. Give them the new routing number if you do direct deposits. Updating your providers who debit your bank account is the best way. The advantage of users of debit cards is that they do not need to do updates unless the bank gives a new debit card.

Confirm with your past bank statements to be sure that everything is correct

Confirm the content of your statements when you receive the past transaction statements. Ensure the new routing number is correct and everything else therein. It will inform you whether you have updated all your providers or employer. It will also give a list of those who to update.

Check routing number digits represent

A routing number is not just a collection of digits. Like zip codes, routing numbers have a unique format that gives them a distinct meaning. The routing number consists of nine digits which represent different elements. Below is a breakdown of the routing number segments and their meaning.

- First four digits: The first 4 digits in a routing symbol represent the Federal Reserve Routing Symbol. They provide critical banking information on how to process the checks. They show the district location of the bank or the financial institution. There are 12 Federal Reserve Districts throughout the United States.

- Fifth to the eighth digit: Next is a series of four digits that show which bank or financial institution where the check comes from. Every bank or financial institution is within a Federal Reserve District. The numbers are also known as ABA Institution Identifier. The fifth and sixth digits show which bank the transfers should be routed to. The seventh digit shows the initial institution assigned to the bank. The eighth digit designates the district location of the bank or financial institution.

- Ninth digit: Every document which involves cash transaction needs to be verifiable. The ninth digit is the check digit. It is used in verification of the validity of the routing number. The verification involves using a special math formula. Or, the banks can verify the routing number by contacting the issuing bank.

FAQ – Frequently Asked Questions

Can I find my routing number on my debit card?

No. The debit cards do not have a routing number. They are only on checks, online banking platforms, and banking apps. It is also sometimes printed on the deposit slips. If you have a debit card, you should contact customer care to inquire about the routing number.

Why is the routing number on the deposit slip different?

Deposit tickets have an internal routing number while checks have an external routing number. The external encoded number is for deposits. The deposit slip has an 8-digit routing number while checks have 9 routing code. If the external routing number is used on the deposit ticket, the ticket will read as deposit and no credit. The printing of the external routing number on the deposit slip does not make a credit. If you want a deposit slip to post the transaction as a credit, the deposit slip must have an internal RTN.

What happens if I use the wrong routing number?

You should ascertain the correctness of the routing number before making any transaction. There are no stipulated punishments for using an incorrect routing number. However, it can cause serious inconveniences including delays and rejections. If you make a transaction with the wrong routing number, it doesn’t go through. The money can be back in your account.

On the occasions where the money is refunded back to your account, the bank is keen on the details. The bank looks at the details of your account like name, number, and routing number if they match. If there is a mismatch, it will cancel the transaction and have the money refunded to your account. Unfortunately, the transaction fee won’t be part of the refund. Another issue is that it may take a long for the money to appear in your account.

If you realize that you have used the wrong routing number, contact your bank immediately. They will tell you what to do and avoid losses. You can also visit the offices and talk to them about your predicament.

Final Recap

Financial transactions are very sensitive. Whenever making transactions, always be careful with the details in the check slips. The advantage of check slip is that their information is a summary of your account details. When you get yourself into a mess it is always advisable to contact your bank. It is the best and sure way to save yourself and account rating.

It is not bad to inquire before doing any transaction. You may get into some small losses or experience delayed check processing. In most points of the business, there are situations where we cannot control the game. It is always advisable when changes happen with your bank to follow the guidelines, they give you. This will enable you to continue with smooth running with your transactions. Always keep your details updated when bank changes happen. It is also good to update your providers and employers with the new routing number when they change. This will prevent you from receiving delayed payments.

Today unlike in the past, you can do almost all transactions from a physical motor and brick bank. This avails a lot of data online for everyone. You can always compare your data with that in online banking platforms. You can as well call your bank when you have queries. A Routing Number is a key element in the check slip. Always confirm with the bank or previous transaction slips before the next transaction. This will make your banking experience flawless and smooth.