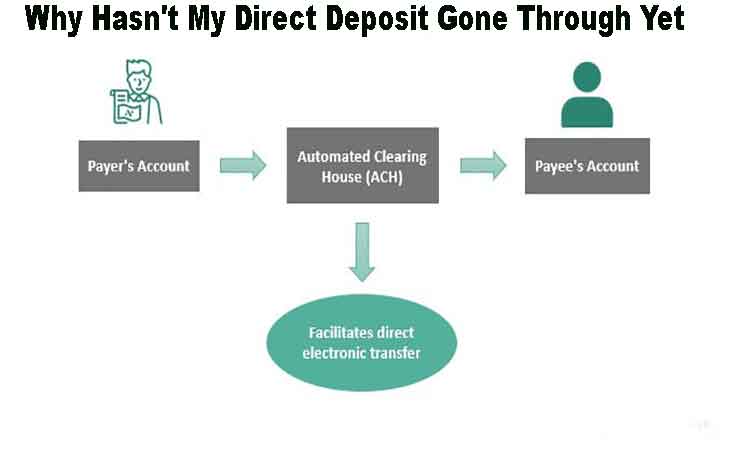

Direct Deposit is a convenient and reliable way of getting paid without having to wait in line at the bank. But what happens when your deposit hasn’t gone through yet? It can be frustrating to wait for your hard-earned money to hit your account. Especially when you have bills to pay and expenses to cover.

There are several reasons why direct deposits may be delayed, ranging from technical glitches to human error. Some common causes include incomplete or inaccurate information on the direct deposit form, delays in processing by the bank, and holidays or weekends. However, once the issue has been identified and resolved, you can expect to receive your funds promptly.

Despite the occasional delay, there are many benefits to using it. It is a secure and paperless payment method that saves time and reduces the risk of lost or stolen checks. It automatically deposits funds into your account without any action required on your part, making it more convenient than traditional payment methods. So, if you’re experiencing a delay in your direct deposit, don’t worry – your money is on its way!

Step by Step to Set Up Direct Deposits

Setting up direct deposit is an easy and convenient way to receive your paycheck or other payments directly into your bank account. By setting up it, you can avoid waiting in long lines at the bank or worrying about lost or stolen checks. Follow these simple steps to set up it today!

- Get the Necessary Information Before setting up direct deposit, you’ll need to gather some basic information from your employer, including your bank’s routing number and your account number. You can usually find this information on a check or bank statement.

- Fill Out the Direct Deposit Form Once you have the necessary information, you’ll need to fill out a direct deposit form provided by your employer. This form will ask for your personal and bank information, as well as the amount or percentage of your paycheck you’d like to deposit into your account.

- Submit the Form After completing the direct deposit form, submit it to your employer or HR department. They will then process your request and set up the direct deposit.

In all, setting up direct deposit is a quick and easy process that can save you time and hassle. By following these simple steps, you can have your paycheck deposited directly into your bank account, ensuring that your funds are available when you need them.

The Time Does Direct Deposit Hit

If you’re like most people, you’re probably wondering what time your direct deposit will hit your bank account. While the exact time can vary depending on your bank and employer, there are some general guidelines you can follow.

In most cases, direct deposits will hit your account in the early morning, between 2:00 AM and 5:00 AM. This is because banks typically process transactions overnight, and direct deposits are no exception. However, it’s important to keep in mind that this is just an estimate, and the exact time may vary depending on your bank’s processing schedule.

If you’re still unsure about when your direct deposit will hit your account, it’s a good idea to check with your bank or employer for more information. They should be able to provide you with a more specific timeline based on their processing schedule.

All-up, while the exact time your direct deposit will hit your account may vary, most people can expect it to arrive in the early morning, typically between 2:00 AM and 5:00 AM. By keeping this in mind, you can plan ahead and ensure that your funds are available when you need them.

Benefits of Direct Deposits

Direct deposit is a convenient and reliable way to receive payments directly into your bank account. There are many benefits to using it over traditional payment methods, including:

- Convenience: It eliminates the need to visit the bank to deposit checks or withdraw funds, saving you time and hassle.

- Security: Funds deposited through it are secure since they are directly credited to your account, making it impossible for them to be lost or stolen.

- Cost savings: It eliminates the need for paper checks, which can save money on printing and processing costs.

- Faster access to funds: With it, funds are available immediately upon deposit, eliminating the need to wait for checks to clear.

- Environmentally friendly: It is a paperless option that helps to reduce waste and minimize your environmental footprint.

Ultimately, direct deposit is a fast, convenient, and secure way to receive payments. By using it, you can enjoy the benefits of faster access to funds, reduced costs, and increased convenience, all while doing your part to help the environment.

Common Causes of Direct Deposit Delays

Direct deposit is a convenient way to receive payments, but sometimes there can be delays. Here are some common causes of it delays:

- Bank processing times: Banks typically process its overnight, so if your deposit is initiated after the cutoff time, it may not be processed until the following day.

- Incorrect account information: If you provided incorrect account information, such as a wrong routing number or account number, your deposit may be delayed or even rejected.

- Holiday weekends: If a holiday falls on a weekend, it can delay its processing times.

- Account freezes: If your account has been frozen due to suspicious activity or other issues, direct deposits may be delayed or rejected.

- Payroll processing issues: If there are issues with your employer’s payroll processing system, it can delay your direct deposit.

To ensure that your payments are received on time, you can avoid common causes of it delays by understanding them and taking necessary steps. If you do experience a delay, it’s important to contact your bank or employer for more information and to take any necessary steps to resolve the issue.

Prevention Methods for Direct Deposit Delays

While there are common causes for direct deposit delays, there are also ways to prevent them from happening in the first place. Here are some prevention methods to consider:

- Double-check your account information: Before setting up it, make sure to double-check that you have provided accurate account information. Incorrect information can lead to delays or even rejected deposits.

- Plan ahead for holidays: If you know that a holiday weekend is coming up, plan ahead and make sure to initiate your deposit early to avoid delays.

- Keep your account active: Make sure to keep your account active and avoid freezes by promptly addressing any suspicious activity or other issues that may arise.

- Stay in communication with your employer or bank: If you are experiencing issues with it, stay in communication with your employer or bank to address any issues and ensure that your deposit is processed correctly.

By following these prevention methods, you can avoid common causes of direct deposit delays and ensure that your payments are received on time. Remember, it’s always better to be proactive and prevent issues from arising than to try to resolve them after the fact.

Direct Deposit Times for Major Banks

Direct deposit can be a convenient and efficient way to receive payments. But the timing of the deposit can vary depending on the bank. Here are the times for some of the major banks:

- Chase Bank: Direct deposits are typically available on the same day they are received, with funds being released between 3 AM and 5 AM EST.

- Bank of America: Direct deposits are typically available on the same day they are received, with funds being released between 4 AM and 6 AM EST.

- Wells Fargo: Direct deposits are typically available on the same day they are received, with funds being released between 12 AM and 3 AM PST.

- Citibank: Direct deposits are typically available on the same day they are received, with funds being released between 12 AM and 6 AM EST.

It’s important to note that these are general guidelines and the exact timing of your direct deposit may vary depending on your specific account and the timing of the deposit. Be sure to check with your bank for their specific policies and procedures for direct deposits.

Risks of Direct Deposits

Here are a few risks to consider:

- Fraud: Direct deposit information, such as your bank account and routing number, can be a target for fraudsters. Be sure to keep your information safe and avoid sharing it with anyone you don’t trust.

- Errors: Mistakes can happen when setting up it, such as entering the wrong account number or routing number. These errors can result in delayed or lost payments, and can be difficult to correct.

- Lack of control: With direct deposit, you may not have as much control over when payments are received and processed. This can be an issue if you need funds quickly or if you prefer to have more control over your finances.

- Fees: Some banks may charge fees for using it. Sometimes it may require a minimum balance in order to qualify for the service.

By being aware of these risks and taking steps to protect your information and monitor your accounts. You can help minimize the potential drawbacks of using it.

Frequently Asked Questions

Here are some Frequently Asked Questions:

What time of day does direct deposit hit?

The exact time can vary depending on the financial institution. Typically, banks process direct deposits early in the morning and make the funds available by 9:00 AM.

Why hasn’t my direct deposit hit yet?

Delays can occur for various reasons, such as inaccurate banking information, holidays, or technical issues. It’s best to contact your employer or financial institution for assistance.

What banks have fast direct deposit?

Many banks offer fast direct deposit, including Chase, Wells Fargo, and Bank of America.

Is direct deposit free?

In most cases, yes. However, some banks may charge fees for certain types of accounts.

How long does direct deposit usually take to process?

The processing of direct deposits usually takes 1-2 business days.

Can I cancel a direct deposit request?

Yes, you can typically cancel the request before the scheduled deposit date.

What happens if my direct deposit bounces?

If it bounces due to insufficient funds or other reasons. Your bank may charge fees and your employer may request a different payment method

Final Take

To sum up, it’s essential to understand the common causes of direct deposit delays to prevent them from happening. The employer and employee must communicate with each other to ensure timely processing of direct deposits. Effective communication between the employer and employee is essential for direct deposits for processing on time. Verify your account information and check the it form for errors to help prevent delays. By taking these steps, you can ensure that your direct deposits arrive on time and avoid any unnecessary stress or financial hardship. Remember, a little preparation can go a long way in ensuring that your direct deposit process goes smoothly.