Welcome to the world of banking, where routing numbers are the backbone of financial transactions! A routing number, also known as an ABA routing number, is a unique 9-digit code assigned to financial institutions in the United States. It serves as a crucial identifier that helps in directing funds to the correct bank account during electronic transactions. In simpler terms, it’s like a postal code for banks. But question is – What is the Routing Number for GO2Bank?

Now, let’s talk about GO2Bank, a digital bank that offers a range of financial services like checking and savings accounts, debit cards, and even credit monitoring. As a customer of GO2Bank, it’s essential to know your routing number as it’s required for all incoming and outgoing electronic transactions. Whether you’re setting up direct deposit or paying bills online, having the correct routing number ensures that your money goes to the intended recipient without any hiccups.

So, if you’re a proud member of GO2Bank, knowing your routing number is as important as knowing your PIN. And hey, who knows, maybe you’ll impress your friends at the next party with your newfound knowledge of banking jargon! Let’s dive into the world of routing numbers and make our financial transactions a breeze.

Explanation of GO2Bank and Routing Number

Welcome to the world of digital banking, where GO2Bank stands out as a popular choice for customers seeking a hassle-free banking experience. GO2Bank offers a range of financial services, including checking and savings accounts, debit cards, credit monitoring, and mobile banking. As a digital bank, it enables customers to access their account information and conduct transactions via a mobile app or online portal, making banking easier and more convenient than ever before.

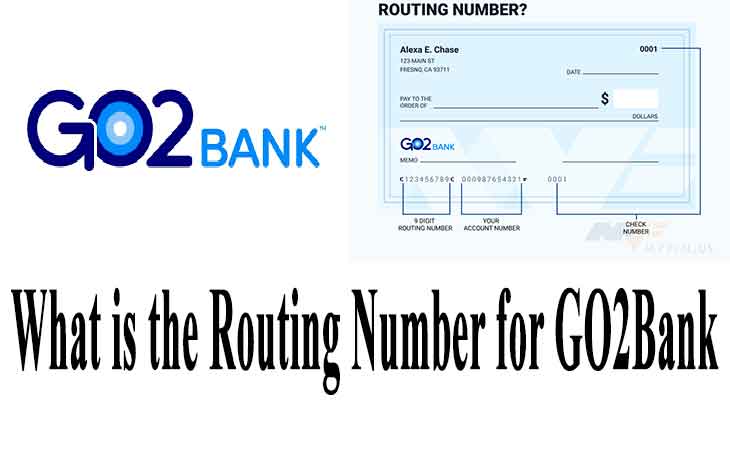

One of the most crucial pieces of information required for electronic transactions is the routing number. A routing number, also known as an ABA routing number, is a unique nine-digit code assigned to financial institutions in the United States. GO2Bank’s routing number is 124303162, and it’s crucial to have this information at hand to conduct seamless transactions.

GO2Bank offers several benefits that set it apart from traditional banks. For instance, it has no minimum balance requirements, no overdraft fees, and offers early access to direct deposits. Additionally, it allows for instant transfers to other GO2Bank accounts, making transactions faster and more efficient.

To locate GO2Bank’s routing number, customers can look at their checks, visit the bank’s website, or contact customer support for assistance. In conclusion, GO2Bank’s user-friendly interface, extensive range of services, and easy accessibility make it a popular choice for digital banking enthusiasts.

Finding the Routing Number for GO2Bank

If you’re a customer of GO2Bank, knowing your routing number is crucial for conducting electronic transactions. A routing number is a unique nine-digit code that identifies the financial institution you’re banking with. Without the correct routing number, your funds could end up in the wrong account or be delayed, leading to unnecessary headaches. So, where can you find GO2Bank’s routing number?

Firstly, you can check your checks. Your routing number is typically located in the bottom left-hand corner of your check. Additionally, you can find GO2Bank’s routing number on the bank’s website or mobile app. Simply log in to your account and look for the routing number under account information.

It’s essential to have accurate routing number information to avoid any issues when conducting transactions. Providing an incorrect routing number can result in delayed payments, missed payments, and even the loss of funds. It’s important to double-check the routing number before making any transactions to ensure the funds go to the intended recipient.

In all, knowing GO2Bank’s routing number is crucial for conducting electronic transactions. Whether you’re using checks, the website, or the mobile app, ensure that you have the correct information to avoid any issues. By following these simple steps, you can rest assured that your transactions will be smooth and hassle-free.

Importance of GO2Bank Routing Number

As a GO2Bank customer, your routing number is a crucial piece of information that enables you to conduct electronic transactions smoothly. Without it, you may encounter delays, missed payments, and even the loss of funds. Here are a few reasons why knowing your GO2Bank routing number is essential:

Firstly, it facilitates money transfers. Whether you’re transferring funds to another GO2Bank account or to a different financial institution, having the correct routing number is crucial. The routing number identifies the financial institution and ensures that the funds go to the intended recipient.

Secondly, a routing number is required for direct deposits. If you receive your paycheck or government benefits directly into your GO2Bank account, your employer or the government agency will require your routing number to initiate the direct deposit.

Thirdly, having the correct routing number is necessary for automatic bill payments. By setting up automatic bill payments, you can ensure that your bills are paid on time, without the hassle of manual payments. Having the correct routing number is essential to avoid any missed payments or late fees.

Lastly, wire transfers also require accurate routing number information. If you need to transfer funds internationally or to a different financial institution, having the correct routing number is necessary to ensure that the funds reach the intended recipient.

To summarize, knowing your GO2Bank routing number is crucial for conducting seamless electronic transactions, including money transfers, direct deposits, automatic bill payments, and wire transfers. It’s essential to have this information at hand to avoid any unnecessary delays or issues when conducting transactions.

Ways to Use GO2Bank Routing Number

As a GO2Bank customer, there are several ways you can use your routing number to make your financial life easier. Here are a few examples:

Firstly, you can use your GO2Bank routing number to send money to other people. Whether it’s to a friend, family member, or business, having the correct routing number ensures that the funds reach the intended recipient quickly and securely.

Secondly, you can use your routing number to receive money from others. This can include payments from clients, refunds from retailers, or even gifts from loved ones. With the correct routing number, you can ensure that the funds are deposited into your GO2Bank account without any issues.

Thirdly, setting up automatic bill payments is a breeze with your GO2Bank routing number. By providing your routing number to your service providers, such as utility companies, cable providers, or credit card companies, you can have your bills paid automatically without having to worry about missed payments or late fees.

Lastly, your routing number is necessary for direct deposit. If you receive your paycheck or government benefits directly into your GO2Bank account, having the correct routing number is essential to ensure that the funds are deposited correctly and on time.

Ultimately, your GO2Bank routing number is a crucial piece of information that can make your financial life easier. Whether it’s sending or receiving money, setting up automatic bill payments, or receiving direct deposits, having the correct routing number ensures that your transactions are completed without any unnecessary delays or issues.

Difference Between GO2Bank Routing Number and Account Number

When it comes to banking, it’s essential to understand the differences between your routing number and account number. Your account number is a unique identifier that is assigned to your specific account by your bank or financial institution. It is used to identify your account when you make transactions, such as deposits or withdrawals.

On the other hand, your routing number is a nine-digit code that identifies your bank or financial institution. It is used to route transactions between banks and ensure that the funds reach the correct destination. In other words, your routing number acts as a “roadmap” for your transactions, while your account number identifies your specific account.

One way to think about it is that your account number is like your home address, while your routing number is like your zip code. Your home address tells people exactly where you live, while your zip code helps to identify your general location.

In summary, your account number and routing number are both essential pieces of information for your banking transactions. While they may seem similar, they serve different functions in ensuring that your transactions are completed accurately and efficiently. By understanding the differences between these two numbers, you can ensure that your banking experience is smooth and hassle-free.

Understanding ACH Transfers

ACH (Automated Clearing House) transfers are a popular method of electronic funds transfer that allow businesses and individuals to move money between bank accounts in the United States. The ACH network is operated by the Federal Reserve, and it handles billions of transactions every year.

One of the key benefits of ACH transfers is their convenience. Unlike wire transfers, which can be expensive and time-consuming, ACH transfers are usually free or very low-cost, and they typically take just a few days to clear. This makes them an ideal option for businesses that need to make regular payments or individuals who want to pay bills or send money to friends and family.

To make an ACH transfer with GO2Bank, you will need to provide the recipient’s bank routing number and account number, as well as some additional information such as their name and address. Once you have entered this information, you can initiate the transfer through the GO2Bank app or website. GO2Bank also offers a feature called Pay Friends, which allows you to send money to other GO2Bank customers instantly, without needing to enter their routing and account numbers.

Frequently Asked Questions

When it comes to managing your finances with GO2Bank, you might have some questions about routing numbers. Here are some frequently asked questions to help you understand:

Can I use a routing number for a different bank with GO2Bank?

No, you can’t use a routing number for a different bank with GO2Bank. Each bank has its unique routing number, and using the wrong one could result in delayed or lost transactions.

How do I know if I have the correct routing number for GO2Bank?

You can check your GO2Bank routing number by logging into your account on the GO2Bank mobile app or website. You can also find it on the bottom left corner of your checks.

Are routing numbers the same for all GO2Bank customers?

No, each GO2Bank customer has a unique routing number. It’s essential to use the correct routing number for your account to avoid any issues with your transactions.

What happens if I use the wrong routing number for GO2Bank?

If you use the wrong routing number for GO2Bank, your transaction may be delayed, rejected, or sent to the wrong account. It’s essential to double-check the routing number before initiating any transfers.

How to make an ACH transfer with GO2Bank?

To do an ACH transfer with GO2Bank, log in, go to “Transfer,” and choose “ACH Transfer.” From there, follow the instructions to complete the transfer. It’s essential to have the correct routing and account numbers for the transfer to go through smoothly.

Conclusion

To sum up, knowing the routing number for GO2Bank is crucial for a variety of financial transactions. Accurate routing number information is essential for sending/receiving money or setting up direct deposit/bill payments/wire transfers. It facilitates seamless money transfers and ensures that your transactions are processed efficiently.

In addition to its routing number, GO2Bank offers numerous benefits and services that make banking easier and more convenient. GO2Bank offers a top-notch banking experience with mobile app, no-fee overdraft protection, and cashback rewards.

Overall, we highly recommend GO2Bank to anyone looking for a reliable, user-friendly banking solution. Its routing number is just one piece of the puzzle, but it’s an important one that shouldn’t be overlooked. Have your routing number ready for financial transactions and enjoy other benefits of GO2Bank.

Leave a Reply